Our Services

Who are Mortgage Advice Bureau?

Mortgage Advice Bureau is the UK’s leading mortgage intermediary brand, winning over 200 national awards for the quality of its advice and service. With over 2,000 advisers across the UK, we offer expert mortgage advice on a local, regional and national level to UK consumers, both face-to-face and over the phone.

The expert advice we offer, combined with the volume of mortgages that we arrange, places us in a very strong position to ensure that our customers have access to the latest deals available and receive a first-class service.We handle over £16 billion of loans annually, and were the first - and are currently the only - mortgage intermediary to have floated on the London Stock Exchange, having joined the Alternative Investment Market (AIM) in November 2014.

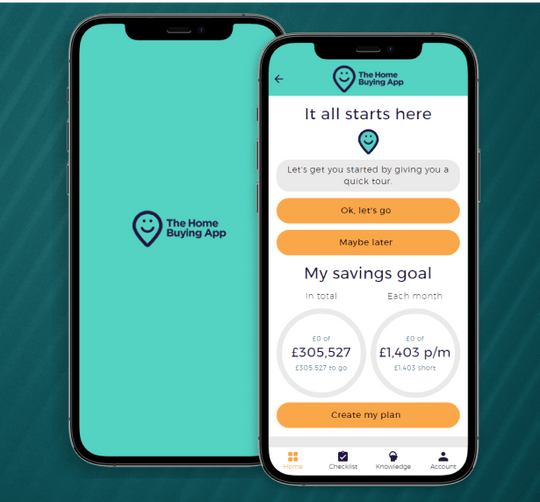

Home buying with a helping hand?

Everything you need to buy your next home, whenever you need it. Download the app to track every step of your home buying journey.

How much can I borrow?

By using our mortgage calculators, we can help you understand key things like how much you can borrow, what your mortgage repayments may be, so you can feel mortgage ready.

Try our calculator

Why Use Us?

- We work with Mortgage Advice Bureau to search 1,000s of mortgage deals to find the right one for our customers' circumstances and needs. Some of these schemes cannot be found on the high street and are exclusive to Mortgage Advice Bureau.

- We can provide face-to-face and telephone advice for our customers.

- We pride ourselves on our professional service, which continues throughout the lifetime of our relationship, not just when your mortgage completes.

- We provide a full range of lifestyle and income protection cover to protect you from the unexpected.

- We cover all aspects of property-related lending including Buy-to-Let, Affordable Housing schemes and many more.

Because we play by the book we want to tell you that…

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances.

The fee is up to 1% but a typical fee is 0.3% of the amount borrowed.

For the insurance business, we offer products from a choice of insurers.

Who are Mortgage Advice Bureau?

Mortgage Advice Bureau is the UK’s leading mortgage intermediary brand, winning over 200 national awards for the quality of its advice and service. With over 2,000 advisers across the UK, we offer expert mortgage advice on a local, regional and national level to UK consumers, both face-to-face and over the phone.

The expert advice we offer, combined with the volume of mortgages that we arrange, places us in a very strong position to ensure that our customers have access to the latest deals available and receive a first-class service.We handle over £16 billion of loans annually, and were the first - and are currently the only - mortgage intermediary to have floated on the London Stock Exchange, having joined the Alternative Investment Market (AIM) in November 2014.